Thank you very much to all of you for your valuable feedback through our survey! Based on your answers, here is what a typical Friend of Finance Watch (at least the ones who complete surveys) seems to look like ;)

A man (77%), aged about 45 years old + (53%), employee (41%), retired (19%) or self-employed (16%), mainly from France, Germany or Belgium (84%). He mainly follows FW to monitor (52%) and play a role (58%) in the decision making in Brussels. He understands some (38%) or most (53%) of what he reads about finance , and he would like FW to come with new ideas for reforming finance (72%) as well as analysis of current issues (60%). Finally, he likes to read all FW publications (67%), and he would like something more visual like cartoons or infographics (55%). |

|

Win a book!

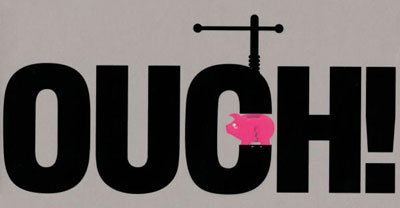

Have you ever asked yourself how money really works in our society? Well, you might consider reading "OUCH!", Paul Knott's new book. This provoking and entertaining book will give you some key information about the origins of money and how it works, as well as the human psyche and the quality of financial information you can have access to.

"We live in a world dominated by a system that most of us aren't aware of, never mind understand. When it comes to money and how it really works, most of us are too busy, too bored or too bewildered to think about it, despite being at the sharp end of the consequences. We simply don't recognise the game that is being played out in front of us. Well check your pockets; you're in for a nasty shock." The tone is set...

To win a copy of the book, send us the answer to the following question to friends@finance-watch.org, before 15 February 2013: In what year did a European bank start to print banknotes for the first time?

Info: Knott, P., OUCH!, Publisher: Pearson, 2012, 280 pages /

Watch a video interview with Paul Knott.

|